What you may need to know about making personal contributions, claiming a tax deduction and annual member statements.

It’s hard to believe we’re already halfway through 2021 but the end of the financial year is just around the corner. Although you may be more focused on catching a bargain or trying to gather all those receipts you’ve shoved away somewhere than taking a look at your super, there are a few things you may need to know about managing your super at tax time.

We wrote this guide to help you navigate the EOFY like a pro.

Making a Personal Contribution

Personal contributions are voluntary contributions you can make into your super fund in addition to the compulsory contributions made by your employer.

People often make personal contributions to their super to boost their retirement savings. Personal contributions may also be claimed as a tax deduction to reduce your total tax liability (but more on that later).

Some people may also make personal contributions to their super as a way to save for a house deposit under the First Home Super Saver (FHSS) Scheme. You can read more about that here.

Personal contributions will remain preserved until a condition of release occurs, such as retirement after reaching preservation age, or an early release benefit payment is approved.

You should speak to a qualified tax accountant or financial adviser before making any personal contributions. Please confirm you are eligible to make contributions to your Future Super account before depositing funds.

You can make a personal contribution to your Future Super account in 3 easy steps:

- Log into your Account.

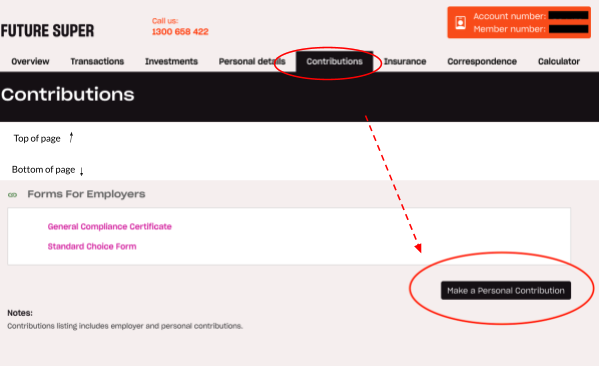

- Complete the online Personal Contribution Form. You will find this through the “Make a personal contribution” button at the bottom of the Contributions page.

Contributions page of Future Super member account

- Transfer the funds from your bank to Future Super. Use the BPAY or direct deposit details provided in the personal contribution form. Use your personal payment reference number (located on the form) when transferring the money.

Some important things to note:

Please be sure to use the correct payment reference number when you make your payment. This allows us to correctly identify your personal contribution as yours and allocate it to your account.

If you are unable to find your payment reference number, please please get in touch with us at info@futuresuper.com.au or call us on 1300 658 422.

To ensure your funds are received and allocated to your account in time for the 2020/21 financial year, we recommend making any personal contributions by the 25th June 2021. This allows for bank processing times. Contributions are allocated to your account based on the date we receive them into the Fund’s bank account.

Claiming a tax deduction for personal contributions

Personal contributions are automatically allocated as non-concessional contributions. This means that they are not taxed when they go into a super account because they come from your after-tax income.

However, you may be able to claim personal super contributions as a tax deduction. This may reduce your taxable income when lodging a tax return by the amount of the contribution claimed in that financial year.

To claim your personal contributions as a tax deduction, you must complete and submit a Notice of intent to claim or vary a deduction for personal super contributions form (Notice of Intent) to info@futuresuper.com.au. You can submit a Notice of Intent once per year for all personal contributions made in a financial year. This will mean that your personal contributions will become concessional contributions and 15% tax is withheld by the super fund to be paid to the ATO.

Please note, you can submit a Notice of Intent up until the earlier of either:

- before the end of the day that you lodge your income tax return for the income year in which the personal contributions were made; or

- before the end of the financial year following the year in which the contribution was made.

Once your Notice of Intent has been applied to your account, we’ll provide you with a letter of acknowledgement for your reference. You may need this for lodging your tax return.

You can read more about how super benefits are taxed here.

Member Statements

Members often ask us for annual member statements soon after 1st July, thinking that they need their statement to complete their tax return. However, this is generally not the case.

If you are a member and have received a benefit payment during the financial year, you should have received a PAYG Payment Summary if tax was withheld. You can use this for your tax return if you need to. If you have not received a PAYG Payment Summary and have received a lump sum payment, you can reach out to us at info@futuresuper.com.au or call us on 1300 658 422.

If you do need an account summary before the annual member statements are released (usually between October - December), you can download an Interim Account Activity Summary from the Transactions section of your Account. Alternatively, you can request an Interim Account Activity Summary via email to info@futuresuper.com.au or phone on 1300 658 422.

FAQs

Is there an age limit for making personal contributions?

Yes, there are some age restrictions for making personal contributions. If you are under 67 you can make personal contributions regardless if you are working or not. If you are between 67 and 74 you must pass the work test or work test exemption to be eligible to make personal contributions. If you are over 75 you cannot make personal contributions.

Do I have to fill out a contribution form every time I make a payment?

Not necessarily. If you make contributions with the same amount, frequency (e.g. every 4 weeks) and payment reference, then you can note this in one form. However, if you make contributions of varying amounts or at varying frequency, you will need to complete a new personal contribution form each time.

Do personal contributions count towards my contributions cap?

Yes, personal contributions will count towards contribution caps.

If you claim a tax deduction for a personal super contribution, the contribution will count towards your concessional (before-tax) contributions cap of $25,000.

If you choose not to claim a tax deduction for your personal contribution, the contribution will count towards your non-concessional (after-tax) contribution cap of $100,000.

Please note, the contribution caps will change on 1st July 2021. For more information on contribution caps and the upcoming changes, please refer to this ATO webpage.

Can I use some of my contribution cap allowance from other years?

Yes, you may be able to access your unused contribution caps from other years under the carry-forward arrangements for concessional contributions or bring forward arrangements for non-concessional contributions.

Eligibility conditions apply. Please read the eligibility criteria carefully to find out if these arrangements are available to you.

For more information, the ATO’s website has a useful guide for concessional contributions and non-concessional contributions.

Please note that the information provided is of a general nature only and we have not taken your personal financial objectives, situation or needs into account.

We recommend you seek financial advice when considering if Future Super is right for your objectives and needs.

Please read our Product Disclosure Document and Additional Information Booklet for more information about our products and services.